33+ prorated property tax calculator

Step 1 Start by finding out the total amount of property tax for the property during that tax year. Web PA Property Tax Calculators.

Reservations Long Term Reservations Resort Data Processing

To further complicate matters youre actually paying the last fiscal years property taxes.

. Web Transnation Title Proration Calculators Prorations By Value Prorations By Bill Character. Please note that we can only estimate your property tax based on median property taxes in your area. Web The property tax estimator assumes that property taxes are paid on September 1st and March 1st.

This calculator is an estimating tool and does not include all taxes that may be included in your bill. A salary of 50000 in Fawn Creek Kansas should increase to 51890 in Goodland Kansas assumptions include Homeowner no Child Care and Taxes are not considered. Web 2023 Cost of Living Calculator.

Every locality uses a unique property tax assessment method. Web You can use a property tax proration calculator if math is not your strongest suit. This calculator is designed to estimate the real estate tax proration between the home buyer seller at closing.

Allegheny County Beaver County Butler County Washington County Westmoreland County. Web Tax Proration Calculator Closing Date. Multiply the daily rate by the number of days the seller owned the property for his amount.

Web Web Use the property tax calculator to estimate your real estate taxes. November 2022 Pay 2023 Second Half Taxes Paid. We know how exciting and confusing real estate transactions can be and we are here to make sure closing yours is as easy and enjoyable as it can be.

To do this the seller needs to produce a copy of the tax bill. But we have tried to simplify the calculations as much as possible. Ad Enter Any Address Receive a.

That means that when paying property taxes in a given year youre paying last years taxes. Please note that we can only estimate your property tax based on median property taxes in your area. Web In year one local assessing officials appraise real estate to determine a market value for each home in their area.

This service is being provided for informational purposes only. Web Our closing calculators are more helpful than the most other available closing calculators in that they based on on the inputed price our computer automatically calculate your estimated real estate commission the Illinois Cook County and Chicago transfer taxes real estate prorated tax credits prorated association assessments and title charges. May 2022 Pay 2023 First Half Taxes Paid.

Theyre available on the internet and you can punch in all the numbers and get a quick response. Adams County Armstrong County Bedford County Berks County Blair County Bradford County Cambria County Cameron County Carbon County Centre County Chester County Clarion County Clearfield County Clinton. Web The easiest way to prorate your property taxes is to use a tax proration calculator.

Web Property Tax Proration Calculator. Web Most annual property taxes include a computation based on a percentage of the assessed value. The assessed value of property in most of Illinois is equal to 3333 one-third of the market value of the residential property though it may be different in certain counties.

Web Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an Online Tool to customize your own personal estimated tax. Do not rely on the results from this calculator to make financial decisions. ORDER TITLE Transnation Title Agency is committed to you.

Web Property Tax Tools - Free Property Tax Rate Calculator Property Tax Estimator State County Appraised Property Value Disclaimer. Web To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address. This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year.

Web At a real estate closing you pay a prorated portion of property tax. Iowa property taxes are paid in arrears. Fawn Creek Kansas vs Goodland Kansas.

To determine the tax rate the taxing jurisdiction divides the tax levy by the total taxable assessed value of all property in the jurisdiction. Divide the prior years amount of property tax by 365 for the daily rate. Click here to customize.

States such as California increase the assessment value by up to 2 per year. Keep that number handy. Your amount depends on whether youre the buyer or seller.

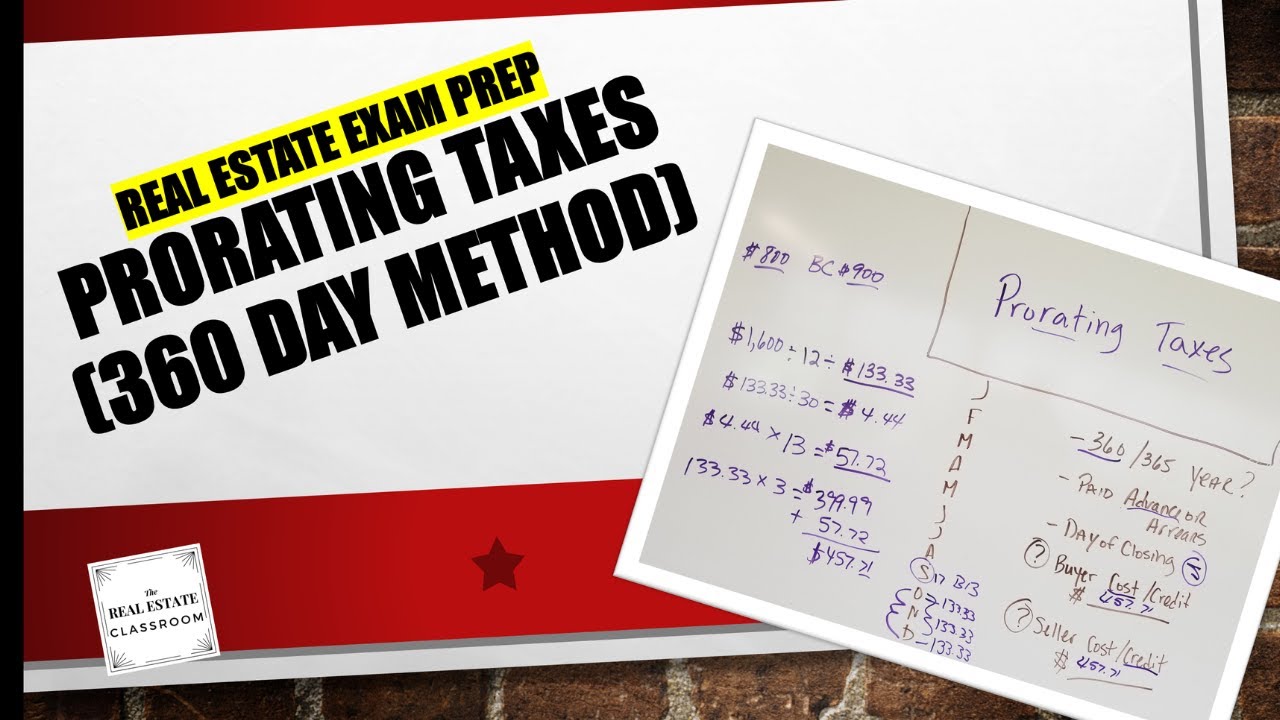

Real Estate Math Video 6a Prorate Real Estate Taxes 360 30 Day Method Real Estate Exam Prep Youtube

Property Tax Estimator For All The U S Counties 2023 Casaplorer

How To Calculate Prorated Rent And When To Do This

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Property Tax Time In Texas Tax Prorations Independence Title

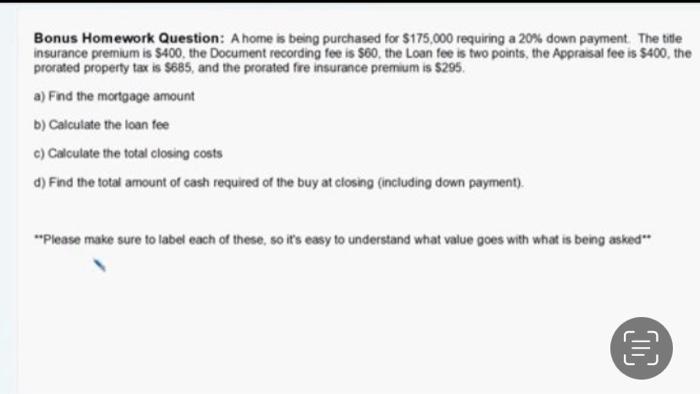

Solved Bonus Homework Question A Home Is Being Purchased Chegg Com

Property Tax Proration Va Guidelines On Va Home Loans

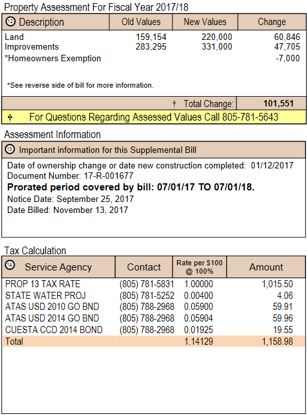

How To Read Your Supplemental Tax Bill County Of San Luis Obispo

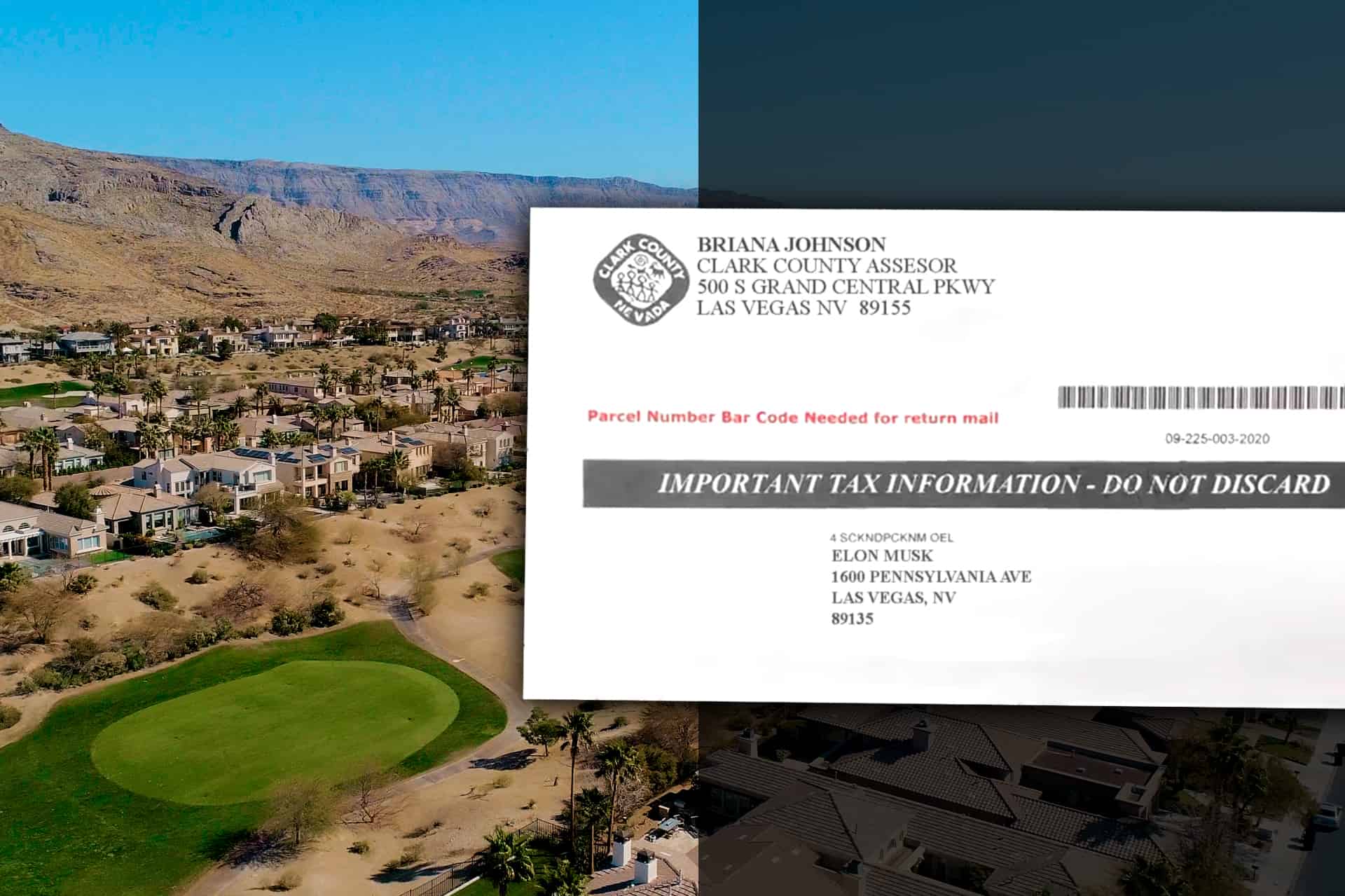

Las Vegas Property Tax Frequently Asked Questions Rob Jensen Company

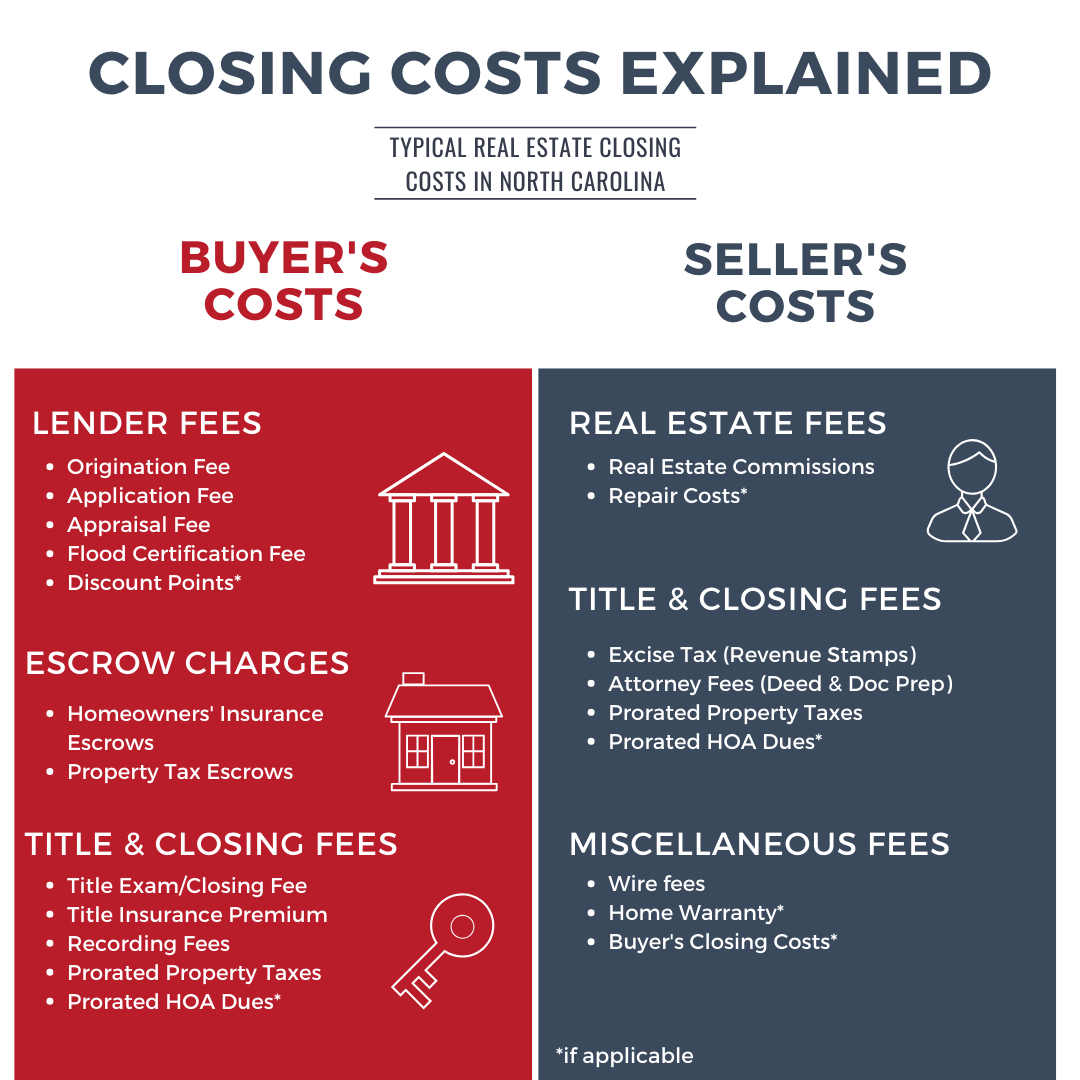

How To Calculate Closing Costs On A Nc Home Real Estate

The Property Tax Equation

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

How To Estimate Commercial Real Estate Property Taxes Fnrp

Tax Advice For U S Citizens In Germany And Europe

Property Tax Calculator Estimator For Real Estate And Homes

Secured Property Taxes Treasurer Tax Collector

Plains Commerce Bank How Are Property Taxes Calculated