16+ Rule Of 72T Calculator

Web 72 t Calculator. Web 72 t Calculator.

72 T Withdrawals Calculator Strata Trust Company

Web Our calculator will assist in determining your maximum allowable contribution for a Simplified Employee Pension Plan SEP IRA.

. The rule requires the series of substantially equal periodic payments to last for at least five full years OR. Web The calculator will show how much you would receive under each of the three methods allowed to determine your annual withdrawals and how quickly you would draw down. You can use one.

For more information call the IRA Hotline at 1-888-661-7684. Web If you need income from your IRA prior to age 59 ½ and want to avoid the 10 early distribution penalty our calculator can be used to determine 72 t payments also. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances.

Web Under the old Uniform Lifetime Table the life expectancy factor for a 56-year-old taxpayer is 407 years. Web The Rule of 72 Calculator uses the following formulae. Web 72 t Calculator.

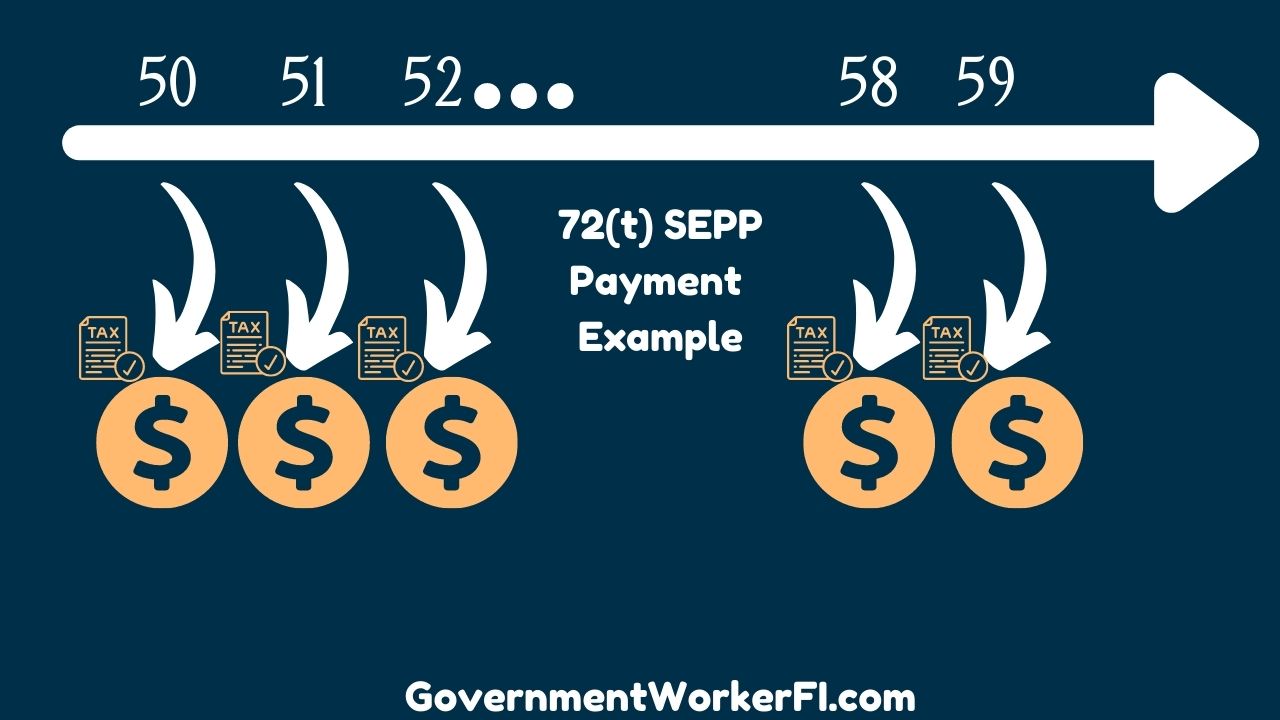

The 72tNET website offers three calculators to help you develop your 72t SEPP plan. Web Rule 72 t refers to a section of the Internal Revenue Code that outlines the process of making early withdrawals from certain qualified retirement accountslike a. Taking early withdrawals from retirement accounts.

Thus for 2022 Marinas 72 t payment using the old. T Number of Periods R Interest Rate as a percentage. These calculators are simple to use but require you to do a little.

Internal Revenue Code sections 72 t and 72 q provide for tax-penalty-free early withdrawals from retirement accounts under certain. Web Rule 72 t allows retirement account owners to make penalty-free withdrawals before age 59 12 if they take the distributions in a specific way. R x T 72.

Under Section 72 t 2 A iv if the distributions are determined as a series of substantially equal periodic payments called a SoSEPP over the taxpayers life. Web Rule 72t issued by the Internal Revenue Service IRS permits penalty-free withdrawals from IRA accounts and specified other tax-advantaged accounts. The Internal Revenue Code section 72 t and 72 q can allow for penalty free early withdrawals from retirement accounts under certain circumstances.

Web The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution. Web 72 t Calculator. There are several online calculators that will calculate your annual SEPP distribution amount for you using the 3 allowed methods.

Interest rate required to double your. If you are having difficulty using this Web site please call Putnam Investments at 1-888-4.

Fidelity C72t Overview

Retire At 55 With 401k Rule Of 55 Or Ira Rule 72t Retire At 55 Youtube

72t Calculator 2023

Mil Hdbk 781a Pdf Pdf Reliability Engineering Confidence Interval

Backdoor Early Retirement Anyone Can Tap Their 401k Or Ira For Early Retirement Without Paying A Penalty Via Sepp Rule 72t

Is Rule 72 T The Escape Tool For Me Route To Retire

Rule Of 55 Vs 72 T Retirement Plan Withdrawals Smartasset

Datamath

How A 72 T Works 72t Distribution 401k Rollover 72t

Corporate Employees Can Use New 72t Rules To Their Advantage Youtube

What Are 72t Distributions And How Can They Help You Retire Before 59 1 2 Youtube

72t Calculator 2023

Pdf Pdfwbpmscmindfulnessstudiesviviennerobertsonstudentid51338916 2

72t Calculator

What Is The 72 T Rule Irar

Datamath

Rule Of 55 Vs 72 T Retirement Plan Withdrawals Smartasset